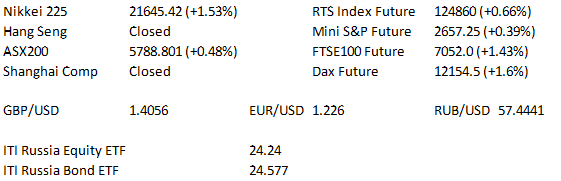

Overnight Snapshot

The Day Ahead

0815hrs UK SZ Swiss CPI (est 0.26%mom/0.67%yoy vs previous 0.4%/0.6%)

0900hrs UK EU EuroZone Service PMI (est 55.04 vs previous 55.0)

0930hrs UK UK Services PMI (est 53.96 vs previous 54.5)

1000hrs UK EU EuroZone PPI (est 0.06%mom/1.46%yoy vs previous 0.4%/1.5%)

1000hrs UK Eu EuroZone Retail Sales (est 0.46%mom/2.25%yoy vs previous -0.1%/2.3%)

1330hrs UK CA Canada Trade Deficit (est -C$2.13bln vs previous -C$1.91bln)

1330hrs UK US Weekly Jobless Claims (est 225.1K vs previous 215K)

1330hrs UK US Trade Deficit (est -$56.57bln vs previous -$56.6bln)

1700hrs UK SZ Swiss National Bank’s Dewet Moser and Maechler speak in Zurich

1800hrs UK US Atlanta Fed President Raphael Bostic speaks in Florida

EU Brexit negotiator Michel Barnier meets with Finnish PM Juha Spila in Helsinki

FTSE100 Ex Dividends today 8.123 Index Points

The Day So Far….

STOCKS: The Wall Street majors staged a comeback yesterday to close around 1% higher as investor focus switched to upcoming earnings and away from the talks of a Chinese tariff war that had hit markets earlier. An early sell off prompted by proposed retaliatory tariffs from China was reversed when President Trump’s top economic adviser stated that the USA was in “negotiations” with China rather than a trade war. This brought comfort to investors and pushed the S&P500 back above the 200 day m.a. to close +30.24 at 2644.69, with the Dow ending up 230.94 at 24264.3, and the Nasdaq100 finishing 101.229higher at 6560.06

Asian stocks have followed US equities higher as investors reassessed the danger of a trade damaging spiral of tariff increases in the world’s two top economies. Japanese and South Korean shares led the charge with Hong Kong and Chinese markets closed for the Ching Ming holiday

US TREASURY: The Aussie curve steepened after benchmark money market rates fell for the first time in seven weeks. Treasuries generally cheapen across the curve in Asia as higher stock prices sap the demand for safer assets

OIL: WTI Crude futures moved towards $64 a barrel as investors received a reprieve from growing American crude stockpiles. The futures gained as much as 0.7% in New York trading, and erased most of their losses on Wednesday after data showed the stocks shrank the most since January against a forecast for a 2mln barrel gain

GOLD: The yellow metal dropped as worries over a full blown trade war eased. Gold fell in Singapore to $1327.7 an ounce as gold contracts globally eased in tandem with a firming dollar and the increased appeal of equities.

Silver and Platinum both eased for the third day in a row

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk