Overnight Snapshot

The Day Ahead

0930hrs UK UK Construction PMI (est 51.87 vs previous 52.5)

1000hrs UK EU EuroZone PPI (est 0.16%mom / 2.24%yoy vs previous 0.1% / 2.1%)

1000hrs UK UK Parliament returns after Whitsun recess

1100hrs UK SW Riksbank Governor Stefan Ingves speaks at Stockholm School of Economics

1200hrs UK EU Bundesbank Board Member Johannes Beermann speaks in Berlin

1230hrs UK EU ECB Governing Council Member Ewald Nowotny speaks in Vienna

1500hrs UK US Factory Orders (est -0.44% vs previous 1.6%)

1500hrs UK US Durable Goods Orders (previous -1.7%)

1800hrs UK UK Bank of England’s Silvana Tenreyro speaks at the University of Surrey

From the US we have earnings from Caseys General Stores, Dell Technologies Class V, and Palo Alto Networks

HEADLINE NEWS: LARGE DEUTSCHE BANK SHAREHOLDER CALLS SITUATION “WORRYING”

The Day So Far….

STOCKS: Wall Street stocks rose on Friday after the latest monthly jobs report pointed to strength in the USS economy whilst geopolitical tensions also eased. Tech stocks led the rally with gains in the 3 heavyweights Apple, Microsoft and Alphabet lifting the S&P Tech Index to an all time high, whilst the Tech heavy Nasdaq100 closed 116.196 points higher at 7083.925. Government data showed that in May the US economy added 223000 Non Farm jobs with average hourly pay increasing 0.3%, both numbers beating economist estimates. The rate of unemployment fell to an 18 year low of 3.8%. Markets also got a reprieve from Italian woes as they installed a coalition government which eased the fears of a fresh vote. Donald Trump also announced the resumption of plans to hold a summit with North Korea’s Kim Jong-Un in Singapore. The Dow moved ahead by 219.37 points to 24635.21, whilst the S&P500 closed 29.35 points higher at 2734.62 and the small cap Russell 2000 closed just shy of the all time high set last week.

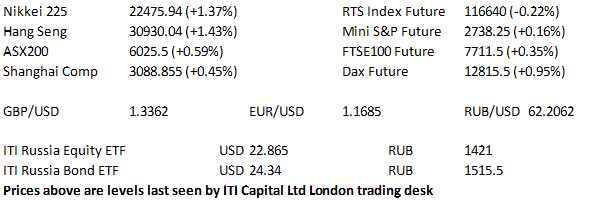

Asia-Pacific stocks took their lead from Friday's US session, which outweighed the negatives surrounding the lack of progress made at the US-China trade talks held over the weekend, and allowed the region's major indices to move higher. The Nikkei 225 added just over 300 points with the materials sector leading the advance, while the energy sector lagged. The Hang Seng has added nearly 450 points so far with the health care sector outperforming, while the energy sector, once again, underperformed. China's Shanghai Composite added 16 points. The ASX 200 added 35 points with real estate leading the way higher, while utilities & telecoms lagged.

US TREASURYS: Tsys have continued from where they left off last week, moving lower in Asia-Pacific trade, with the front end leading the way, resulting in a modestly flatter curve with 3-Year paper underperforming. - Broader risk-on flows have been apparent, with little in the way of fundamental catalysts noted. Traders still seem happy to re-price an increased chance of Fed hikes following the sharp adjustment that was seen in the early part of last week on the back of the Italian political situation, with the Eurodollar strip trading lower yet again. - All of this comes despite the fact that US ComSec Ross' trip to China seems to have yielded little in the way of progress

OIL: The major crude benchmarks continued to trade in a heavy manner after an OPEC committee highlighted the need to ensure stable crude supply, which drew further questions over the longevity of the OPEC+ production agreement. It is also worth noting that Friday's Baker Hughes data saw the number of active US oil rigs reach the highest level since early 2015. WTI futures currently trading down 1c at $65.80 with Brent futures down 10c at $76.69

GOLD: The yellow metal stuck to a tight range sub-$1300/oz, but futures have eased near the lows at $1291 as we approach the European open.

FOREX: The USD is lagging the broader risk on flows despite an uptick in US Tsy yields and trails all of its major counterparts excluding the JPY. The move started around the Japanese cash open, with a notable uptick seen in the Nikkei, following on from the US' equity gains on Friday, with the major Asia-Pacific indices continuing to move higher. AUD has benefitted from positive data releases but there has been little in the way of news flow elsewhere. The TRY has been fairly resilient to Moody's placing Turkey's Ba2 Ratings on review for downgrade back on Friday. - Liquidity was diminished in the early part of today's Asia-Pacific session with New Zealand observing a market holiday.

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates.

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk