Overnight Snapshot

The Day Ahead

0800hrs UK Swedish Finance Minister Magdalena Andersson answers questions in Parliament

1210hrs UK Atlanta Fed President Raphael Bostic speaks in Knoxville

1230hrs UK Bank of England Policy Maker Gertjan Vlieghe speaks in Birmingham

1230hrs UK Canadian CPI (est 1.92% vs previous 1.7%)

1230hrs UK US Durable Goods Orders (est 1.67% vs previous -3.6%)

1400hrs UK US New Home Sales (est 622.58K vs previous 593K)

1430hrs UK Minneapolis Fed President Neel Kashkari speaks in New York

1430hrs UK Dallas Fed President Robert Kaplan speaks in Austin

2300hrs UK Boston Fed President Eric Rosengren speaks in Washington

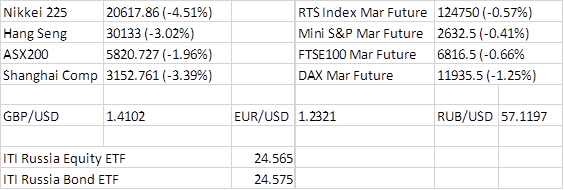

The Day So Far….

STOCKS: US shares slumped yesterday as President Trump’s idea to impose tariffs on imports from China fuelled fears of the impact on the global economy. This pushed stocks to post their biggest declines since they entered a correction phase in early February. Trump signed a Presidential memo that will target the Chinese imports after a consultation period, that should include talks with the Chinese PM. Giving China time to respond should hopefully reduce the risk of tit-for-tat retaliation from Beijing. The S&P500 fell 68.24 points to close2463.69, the Dow dropped 724.42 to 23957.89, and the Nasdaq100 slipped 171.197 to 6682.255

Asian stocks were heavy on Friday, following the lead from Wall St. as worries over Trump's tariffs/retaliation from China & fear over the health of the tech sector spread. - US index futures continued to feel the heat after the closing bell on Thursday,

with the e-mini S&P 10 points worse off & mini-Dow futures 125 points lower.

US TSY/RECAP: ***US Treasuries moved sharply higher on Thursday, viewing 2019 under a more dovish lens than first seen in the wake of FOMC on Wednesday. - Multiple factors added to the rate rally, including a weaker USD vs. JPY & $50bln in tariffs against China spurring risk off flow as equities backed off sharply. Tsys have moved higher in early Asia-Pacific dealing with the white to red Eurodollar contracts 2 to 4.5 ticks higher than settlement. USDJPY has moved below 105.00, HR McMaster has stepped down from his role as chief of the National Security Council & China has announced retaliatory tariffs on the US. - T-notes last 12025, US 10-Year yield last 2.824%.

OIL: Crude moved higher in Asia Pacific hours as US President Donald Trump installed John Bolton as national security advisor, he is viewed as more of a hardliner against the likes of Iran. - WTI last traded around $0.70 higher just shy of $65.00, while Brent added a little over $0.60 to trade around $69.50.

GOLD: The yellow metal benefitted from the heavy risk off flow apparent overnight, adding nearly $10, to trade at $1,339/oz.

FOREX: The greenback has been on the back foot against the majors. HR McMaster stepped down from his role as US national security advisor (in a heavily telegraphed moved) and has been replaced by John Bolton, who is expected to have a harder line on matters in Iran. JPY had been running higher before that announcement as US equity futures continued to come under pressure after the cash close. - Market reaction to China's proposed retaliatory tariffs was fairly muted, as the initial round of proposed countertariffs seem somewhat limited. - The JPY & CHF outperformed as USDJPY consolidated below 105.00, although EUR, GBP, AUD, NZD & CAD all gained against the greenback. - USD-EM Asia crosses were broadly higher, with USDTRY punching to a record high before pulling back, while CNH & CNY operated in a narrow range.

For information on ITI ETFs visit https://itifunds-etf.com

For institutional sales & trading please contact Steve Farrell steve.farrell@iticapital.com

For all dealing enquiries please contact our Trading Desk dealing@iticapital.com