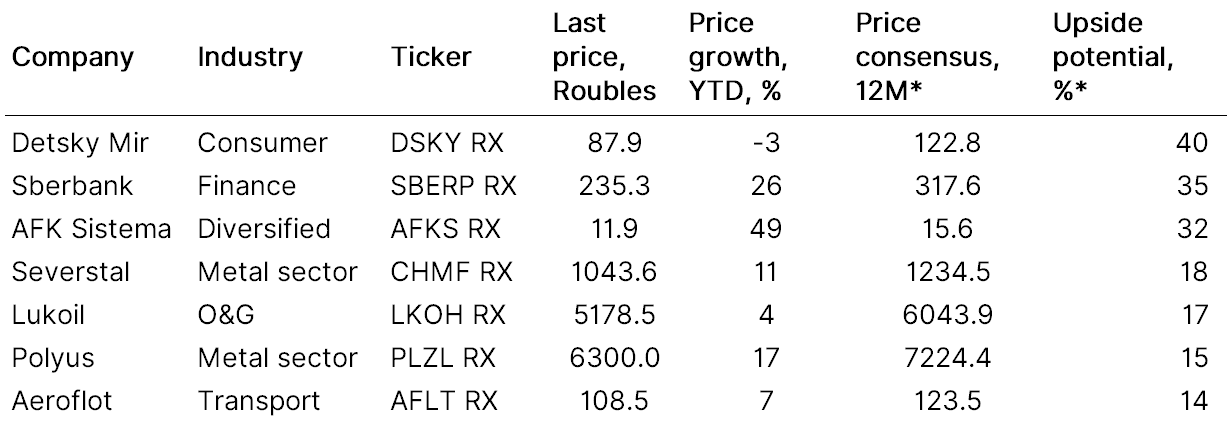

We believe that the demand for risk will extend on the global market throughout Q3. RTS retains good upside potential of climbing to 1,500 bps till the year-end, with nearest resistance level standing at 1,440 bps. The ongoing week is the last one for 2018 dividend payments by the Russian companies, as the market will further focus on fundamentally undervalued local equities and corporate actions. Please see below ITI Capital top picks.

* compiled by Bloomberg

Source: Bloomberg, ITI Capital

Detsky mir — 20% till the year-end

- Moderately strong 2Q19 operating results are expected due to the opening of 17 stores

- The expected next interim dividend yield for 9M19 is 5% (record date in December)

- The current price is unreasonably low (-3% year-to-date) despite strong financial results for 1Q19

Sberbank — 18% till the year-end

- Sberbank is the only stock in the Russian market that has been closely tracking OFZ and the rouble, with the country risk premium already built into prices.

- Therefore, Sberbank is the only blue chip that retains double-digit upside potential till the year-end. According to our estimates, the current risk premium for short OFZs still stands at 30–40 bps till the year-end, Sberbank upside potential is 18–20% till the year-end.

- Sberbank has maintained steady growth and healthy rates of inflow of funds into retail deposits. Sberbank is the largest bank in Eastern Europe, with highest ROE (23.1%) in the sector. The book value per share is only 16% below the current value price.

Sistema — 15% till the year-end

- Since the opening of the trade idea, AFKS RX surged 17%, the stock retains upside potential of 15% till year-end

- The company remains undervalued as compared to the value of its public assets

- Other assets retain growth potential — Ozon, Segezha, Sistema and Rostec microelectronics JV

Severstal — 10% till the year-end

- After operating results for the second quarter released July 12, we may expect strong financial performance (the report will be released July 19) due to a seasonally stronger demand and prices in the Russian market and a bigger share of value-added products in sales

- The company owns an ore production line, higher prices for inputs will weigh on the company's margin

- The expected yield of the next quarterly dividend is 5.6% (record date in late September)

Lukoil — 10% till the year-end

- Since the opening of the trade idea, LKOH RX added 4%, the stocks retain upside potential of 10% till the year-end

- From July 16 to August 14, 2019, the shareholders can redeem them at 5,450 roubles per share under the current buy-back programme (a total of 35 mln shares is to be bought back, the buy-back will be made proportionally to the number of submitted applications), which is 5% above current prices

- As soon as the buyback is over, payment for the shares acquired are made (until August 28, 2019) and they are redeemed, Lukoil will announce the details of a new buy-back programme (in or around September)

Polyus — 8% till the year-end

- Since the opening of the trade idea, LKOH RX climbed 4%, the stock retains upside potential of 8% till the year-end

- The stocks remain undervalued as compared to Polymetal, production will grow further

- Gold prices may rise further, as the Fed is widely seen to cut the key rate in late July. Our target level for gold by the year-end is $1,500/oz

- Polyus is set to increase its free-float from 20% to 25–30%, which will result in greater weight in MSCI Russia and an inflow of $19–29 mln in passive funds, most likely, following a November review. This is the next trigger for the company’s shares

Aeroflot — 6% till the year-end

- Recent drop in jet fuel prices and hedging 70% of jet fuel purchases in 2019 will help stabilizing the bulk of the company's operating expenses (30% of the total for 1Q19)

- Financial results for the second quarter (RAS in early-August, IFRS — in late-August) could contribute to higher share price due to a 11% growth of group-wide traffic in the 2Q19 y-o-y and a rise of EBITDA margin to 24–25% compared to 15.5% in 1Q19