Chelyabinsk steel pipe (ChelPipe) USD Eurobond placement on primary market

Opening date: 12.09.2019

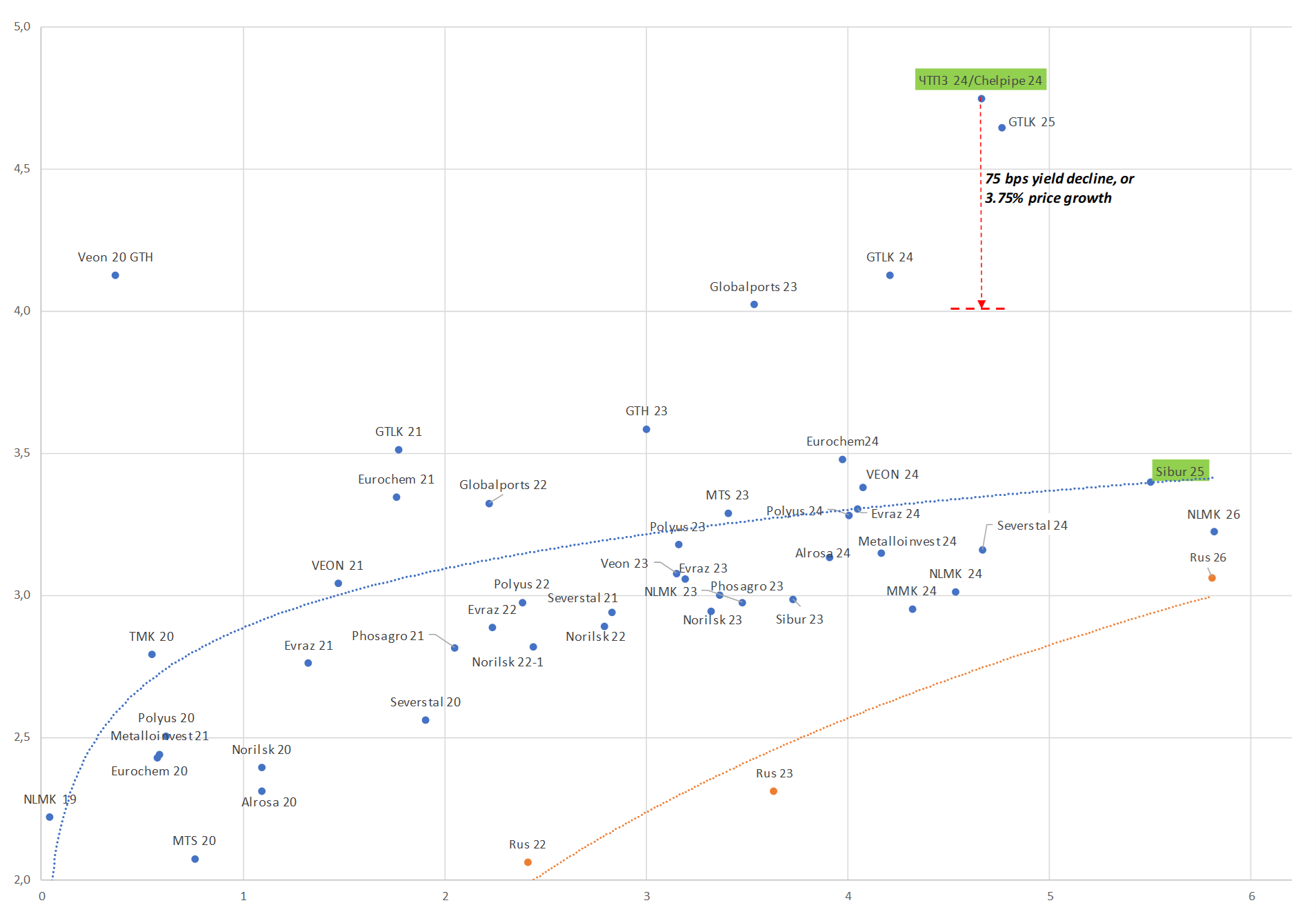

Target price: +3,8% price, 70-75 bps yield decline

The order book closes today at 16:30 Moscow time.

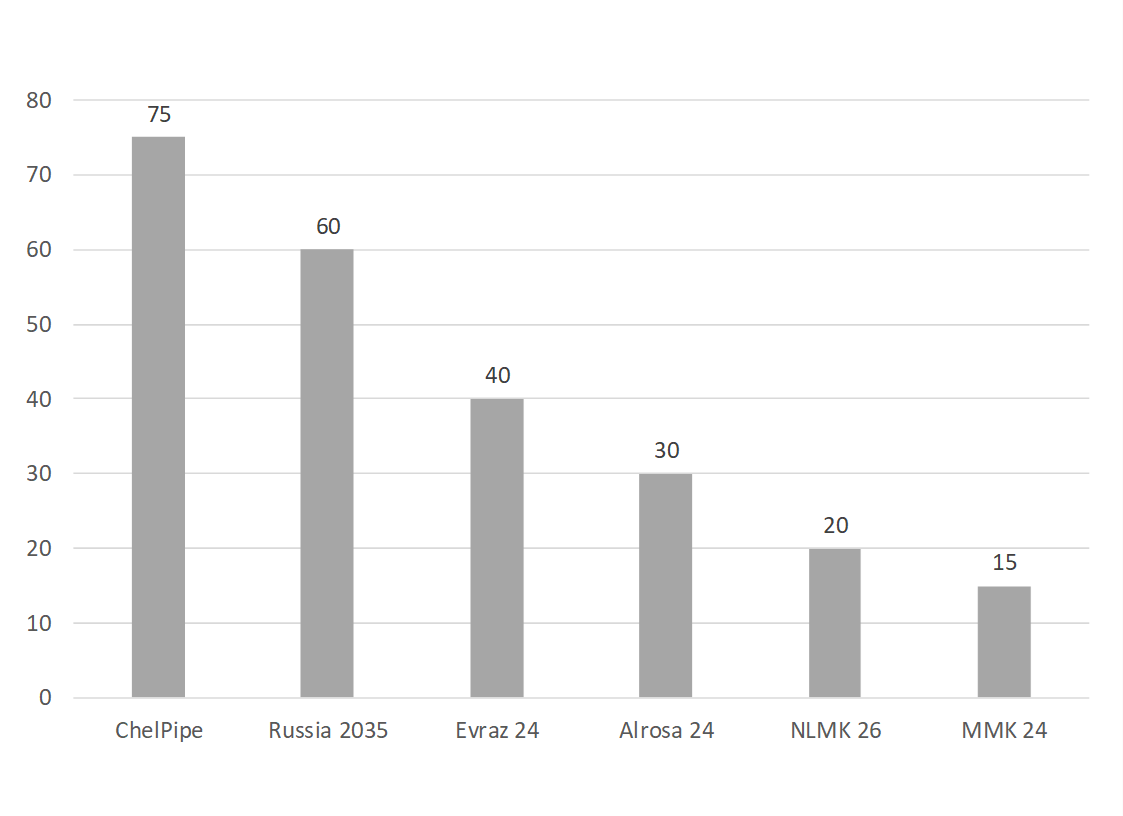

- We called Chelyabinsk (Ba3/BB-) the most attractive of announced debut issues in our recent research

- The announced indicative yield is 4.75–5%, significantly higher than our 4% yields to maturity estimate. Therefore, the current indicator premium is 145-160 bp to the metal sector curve

- We believe that the debut ChelPipe issue should trade at a 70 bps premium to Evraz 24, given higher credit quality and debt burden

- Therefore, after the placement the price upside should reach 4% in near term

- At the same time, ChelPipe yield should be lower than that of GTLK, given that ChelPipe’s net debt/EBITDA is five times lower

Average premium in the primary market, bps

Source: ITI Capital, Bloomberg

ChelPipe: A leader in the Russian tubular products market

- ChelPipe is among the world's top 10 pipe companies, a major domestic producers of tubular products, its share in the Russian tubular goods output is about 17%. ChelPipe Group is comprised of ferrous industry companies, oilfield services providers and manufacturers of main-line equipment. The company offers integrated solutions for the O&G and power engineering. The company's business strengths include a significant share of high value-added products and long-term relationships with key customers. The Company is committed to a balanced investment policy and implements operational improvements. In 2019, ChelPipe has increased its order book by concluding supply contracts for gas pipelines construction projects in Kazakhstan and Turkmenistan

- In 2018, the Company improved its financial performance and reduced its debt. The group's revenue reached 178.8 bln roubles. (+13% yoy), EBITDA margin grew to 15.8% (2017: 14.9%, and net profit amounted to 178.8 bln roubles. (+13% yoy). Net debt/EBITDA dropped to 2.4x from to 2.9x in 2017 and remained stable in 1H2019

- Fitch has upgraded its rating on Severstal to BBB from BBB- on 8 April, the outlook is stable. The upgrade reflected conservative financial policy, very low steel-making costs, focus on high-value added products, and modest capex

Russian corporate bonds yield curve

Source: ITI Capital, Bloomberg