Overnight Snapshot

The Day Ahead

0815hrs UK EU ECB’s Yves Mersch speaks in Paris

0930hrs UK UK Bank of England Inflation Expectations (previous 2.9%)

1315hrs UK CA Canada Housing Starts (est 202.8K vs previous 215.3K)

1330hrs UK CA Canada Unemployment Data (est 22.3K / 5.81% vs previous -1.1K / 5.8%)

1500hrs UK US Wholesale Inventories (est 0.04% vs previous 0.0%)

1800hrs UK US Baker Hughes Rig Count (est 1064 vs previous 1060)

G7 Leaders Summit Held in La Malbaie, Quebec today & tomorrow

No major earnings releases today

HEADLINE NEWS: UK HIGH STREET SEES WORST PERFORMANCE FOR 18 YEARS

RBS MAY RESUME DIVIDEND PAYMENTS THIS SUMMER

BRITISH TELECOM CEO GAVIN PATTERSON TO STEP DOWN

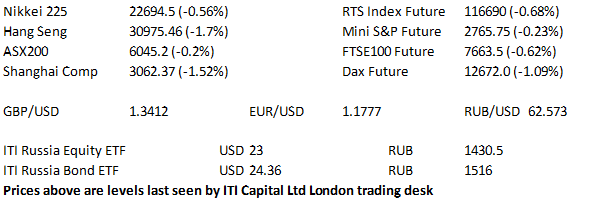

The Day So Far….

STOCKS: The S&P and Nasdaq both slipped yesterday as the Technology led rally ran out of steam as investors turned to safer assets as geo-political tensions rise ahead of the long awaited Korea/USA summit in Singapore next Tuesday and interest rate decisions from both the US and Europe also in the offing. US Treasuries benefitted as prices there gained as trade disputes between the US and major trade partners were in focus ahead of a two day G7 summit in Canada. The S&P500 dipped by just 1.98 points to close at 2770.374, the Nasdaq100 lost a chunkier 57.251 points to end the day at 7152.83, whilst the Dow bucked the trend with a 95.02 point gain to close at 25241.41 spurred on by McDonalds whose shares jumped 4.4% on reports of a new round of layoffs. The S&P Tech index fell 1.1% led by heavyweights Microsoft (-1.6%) and Facebook (-1.7%) with the losses ending a 6 day winning streak that had seen the benchmark hit record levels.

Asia-Pacific stocks traded lower in the final session of the week, as worry surrounding certain EM economies weighed on the region, in addition to fears surrounding trade rhetoric at the upcoming G7 summit also denting sentiment. The Nikkei traded close to unchanged in the morning before moving lower, with the majority of the sectors in the red, led by telecoms & real estate, while utilities provided a degree of cushion to the falls. The Hang Seng has been a one way street all day with steady losses throughout the session with IT & telecoms providing the most weight, with the index well over 500 points lower as we approach the close there. China's Shanghai Composite also saw steady falls, dropping close to 50 points. The ASX 200 outperformed, but still printed modest losses, as the industrials and materials sectors weighed, while consumer staples provided the largest gains. The losses were looking minimal until a near 10 point loss materialized in the closing auction pushing the market back near the daily lows - US index futures printing modest losses with Mini S&P down 6.5 points and Mini Dow down 87 points.

US TREASURYS: US Tsys have continued to tick away from their Thursday melt up highs, with the belly of the curve underperforming in Asia-Pacific hours. It has been a relatively quiet session in terms of headline events, with a focus on the upcoming G7 summit/trade developments and the US-North Korea rhetoric. - Tsy futures surged in the second half of Thursday's session with chatter doing the rounds of a fat finger in T-Notes which ran stops and saw the Tsy complex move higher, although the bulk of the move was quickly unwound.

OIL: Oil's resurgence on Thursday has left crude looking at a weekly gain, with WTI & Brent sticking to a tight range overnight. - Oil was underpinned by issues surrounding Venezuelan exports, with focus still centring on the upcoming OPEC+ meeting, with producers' views over output constraints differing somewhat at present.

GOLD: Gold operated sub-$1300 overnight, after a brief look above the psychological level on Thursday, and lacked any real catalyst to break out of its narrow range.

FOREX: The major FX pairs have stuck to a narrow range in Friday's Asia-Pacific session, with the most modest amount of USD strength apparent. - Trade rhetoric surrounding Friday's G7 summit hasn't offered much new, with Trump maintaining his protectionist stance.

- Elsewhere Japanese GDP & Chinese trade data failed to inspire traders. - In the EM space Argentina has come to an agreement with the IMF, while the Brazilian Central Bank Chief Goldfajn stated that the BCB will intervene via interest rates and the FX market if required. He also revealed that the central bank will offer $20bln via FX swaps over the next week, and will consider doing more if needed.

Please contact ITI Capital London trading desk on dealing@ITICapital.com for further information or updates

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk