Overnight Snapshot

The Day Ahead

0800hrs UK UK Bank of England Governor Mark Carney speaks in London

0800hrs UK US New York Fed President William Dudley speaks in London

0915hrs UK US New York Fed President William Dudley speaks in London

0930hrs UK UK Retail Sales (est 0.69%mom / 0.04%yoy vs previous -1.2% / 1.1%)

0930hrs UK UK Retail Sales ex Auto Fuel (est 0.3%mom / 0.07%yoy vs previous -0.5% / 1.1%)

0930hrs UK EU ECB Executive Board Member Peter Praet speaks in Brussels

1130hrs UK EU ECB Executive Board Member Peter Praet speaks in Brussels

1230hrs UK EU ECB Publishes the Accounts of April Governing Council Meeting

1300hrs UK AU RBA Assistant Governor Michele Bullock speaks in Amsterdam

1330hrs UK US Initial Jobless Claims (est 220.28K vs previous 222K)

1500hrs UK US Existing Home Sales (est 5.56mln / -0.71%mom vs previous 5.60mln / 1.1%)

1535hrs Uk US Atlanta Fed President Raphael Bostic speaks in Dallas

1800hrs UK UK Bank of England Governor Mark Carney speaks in London

1900hrs UK US Philadelphia Fed President Patrick Harker speaks in Dallas

Earnings releases from US include Sears, Best Buy, Splunk & The Gap

No major UK or European earnings

FTSE 100 ex dividend 3.206 points today (Bunzl, Carnival, DCC, Imps, Morrisons, & Whitbread)

HEADLINE NEWS: Elliott Advisors Confirms ‘Significant Stake’ In Thyssen Krup

The Day So Far….

STOCKS: US stocks ended with small gains yesterday after minutes from the latest FOMC meeting suggested higher inflation may not result in faster interest rate hikes. Most of the Fed policy makers thought it likely another rate rise would be in order ‘soon’ if the US economic outlook remains unchanged, and many participants saw little evidence of the labour market overheating according to the minutes. The news prompted stocks to turn higher after trading in the red before the release. The rate sensitive S&P Real Estate and Utilities indexes posted the biggest percentage gains on the day. Financials which generally benefit from higher rates bucked the trend to close down 0.6%. The S&P500 finished the day +8.85 points at 2733.29, the Dow closed 52.4 points to the good at 24886.81, and the Nasdaq100 closed a strong session at 6953.631, 60.011points better.

Risk appetite in Asia was dented. The Nikkei 225 lost over 1% with an almost straight line fall from the open, before steadying near the lows into the lunch break and trading sideways for the rest of the day. , with JPY strength on the back of broader risk off flows adding additional weight to the index after the US auto probe weighed heavily on the auto space. Elsewhere China's Shanghai Composite shed 0.5%, while the ASX bucked the general losing trend to close very slightly positive after a late rally The Hang Seng outperformed adding a little over 0.4%, as the energy sector led the way higher through to mid morning. However selling pressure from the highs saw the market close the morning session virtually unchanged, before further losses in the afternoon, trading on the lows as we near the close. US index futures came under pressure, as the mini Dow currently trades down 40 points and the e-mini S&P down 4 points at the time of writing.

US TREASURYS: The space took a fresh leg higher after WSJ reported that the Trump admin is considering a plan to impose new tariffs on imported vehicles, which he has now instructed the Comm Sec to investigate. The space has gained further ground in Asia-Pacific hours as questions re: the US-North Korea summit continue to do the rounds, with a North Korean foreign min representative noting that he will suggest reconsidering the summit, although he did say that the future of the summit is entirely down to Washington. - Cash Tsys are higher, although the longer end is underperforming. T-Notes sit just off of highs. - The Eurodollar strip has continued to edge higher, and sits a little flatter.

OIL: WTI and Brent lost a little over $0.20 to trade at $71.65 & $79.55 respectively overnight. - This came after Wednesday's DoE inventory report which provided a surprise headline crude draw. - Geopolitical risk centring on Iran & Venezuela continue to underpin the space.

GOLD: Gold added $2 to trade at $1295/oz.

FOREX: JPY was the winner once again as risk off flows did the rounds for a 2nd consecutive Asia-Pac session as the US opened an investigation into levying tariffs on imported autos & as a North Korean diplomat suggested that he would recommend that his country's leadership reconsider attending the upcoming US-NK summit. Yen crosses sold off with chatter that levered Japanese names were behind the move following the Nikkei open. USDJPY breached yesterday's low, while EURJPY managed to register a fresh YtD low on the move. The Antipodeans stuck to a tight range, while EURUSD traded either side of 1.1700. GBP had garnered an early bid on reports that UK PM May is set to seek a new Brexit transition agreement through to 2023, although there was some short term pressure as GBPJPY crossed below trend line support at 147.41, but cable now sits closer to best levels. USDTRY operates near yesterday's closing level after the CBRT's emergency 300bp hike, while the BoK stood pat & reiterated that it will intervene in markets if required, USDKRW stuck to a tight enough range.

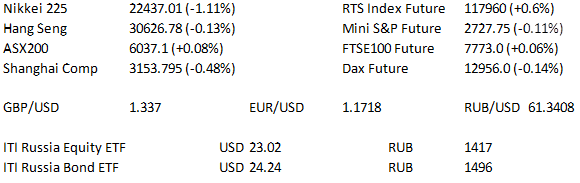

For information on ITI ETFs contact Elio Manca

For institutional sales & trading please contact Steve Farrell

For all dealing enquiries please contact our Trading Desk