- The weakening will continue, given that the rouble now looks overvalued, according to our estimates

- Based on the current oil prices the rouble’s justified rate is 67 per dollar. The current rate is risk- and premium-free, while other Russian assets such as OFZs, Sberbank shares etc have already been trading at a premium emanating from geopolitical situation

- We expect uncertainty over the rouble and other Russian assets to remain, unless Congress decides on sanctions. The bulk of volatility accounts for non-residents, while investors’ appetite depend on geopolitics

- The prospects of further sanctions including against OFZs are set to improve in April, leading to a weaker rouble that may edge lower to 70+ per dollar. Most likely, it will happen after the U.S. — China trade deal

USD/RUB outlook for 2019

- 2H18 will see further seasonality-driven rouble weakening, but the rate will largely depend on sanctions

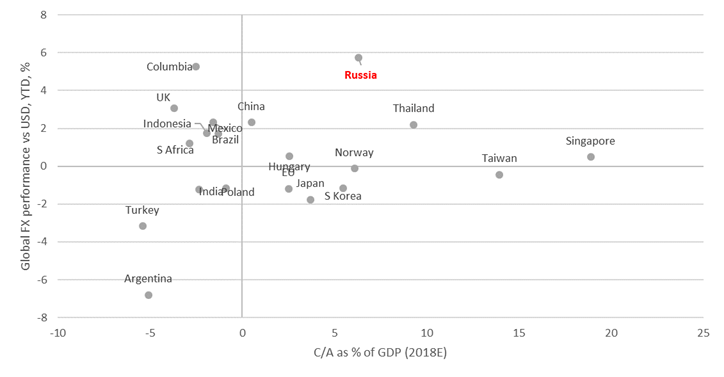

Global FX performance vs fundamentals, %

Source: ITI Capital, Bloomberg

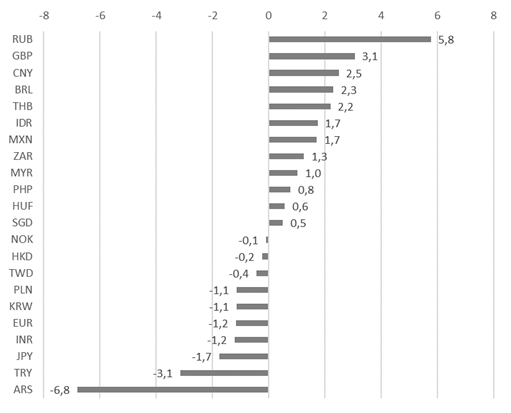

Global FX vs USD, %

Source: ITI Capital, Bloomberg