Current price: $32.71

Target price through January 2020: $36.8

Upside till January 2020: 13%

- On August 13, we added X5 Retail Group’s GDR to ITI Capital’s choice portfolio

- Upside potential till January is 13%, target price is $36.8, according to our estimates

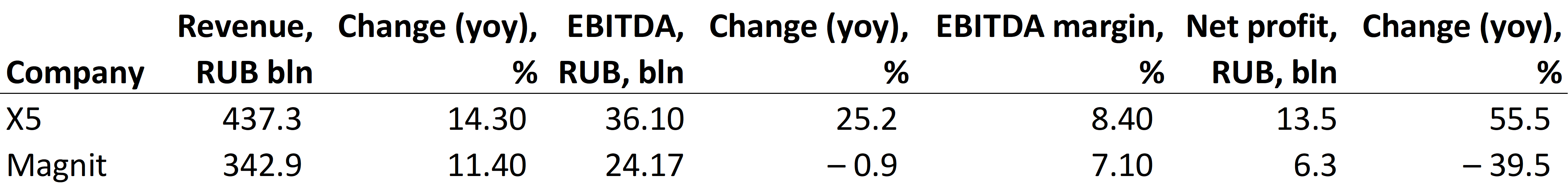

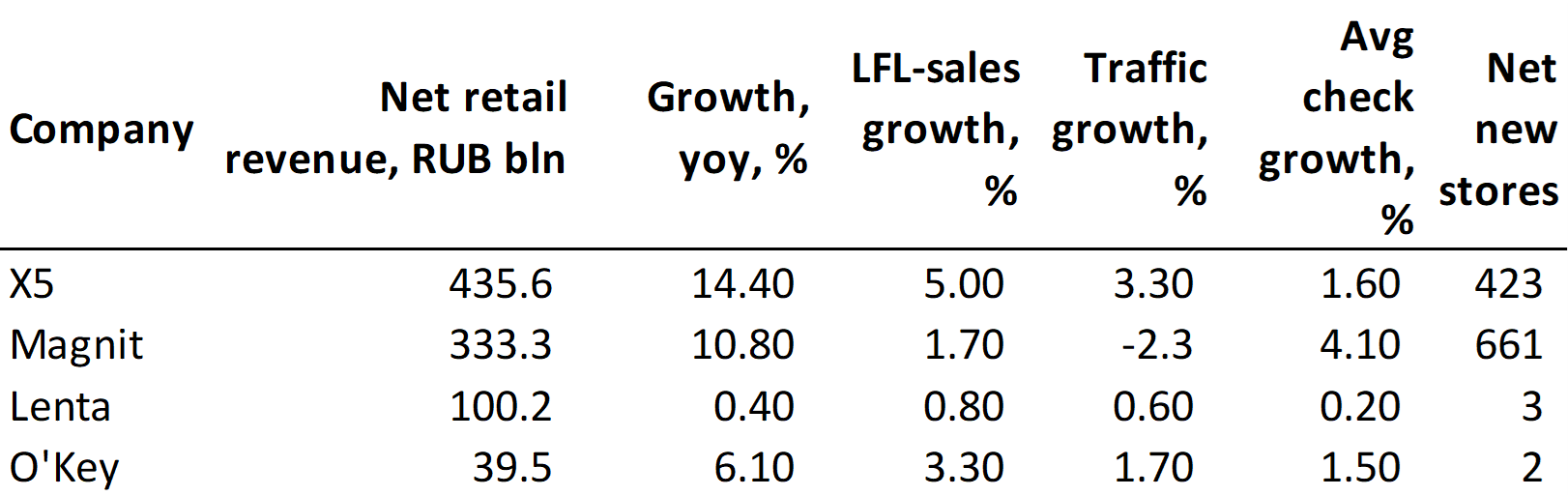

- On August 15, X5 Retail Group reported strong 2Q19 IFRS results. X5 delivered revenue growth of 14.3% yoy on the back of positive like-for-like (LFL) sales (+5%) and selling space expansion (14.1%). Traffic rose 3.3% yoy, average check — 1.6% yoy. EBITDA increased by 25.2% yoy to 36.1 bln roubles due to higher operating efficiency of Pyaterochka and Perekrestok (above Interfax' estimate of 34 bln roubles). EBITDA margin increased to 8.3% from 7.3% in 1Q19. The company expects the indicator to exceed 7% in 2H19

- Net profit reached 13.5 bln roubles (+55.5% yoy, above Interfax' estimate of 11.5 bln roubles) due to higher operating profit, lower financial costs and positive foreign exchange rate

- X5 outperformed Magnit in 2Q19

- X5 reinforced its market leadership in terms of operating results. Perekrestok posted best revenue (+18.1% yoy) and LFL-sales (+7.7%) across the group, Pyaterochka’s net revenue grew 15.6% yoy to 349.4 bln roubles, LFL-sales advanced 4.8%

- In 2Q19, X5 opened 481 new stores and closed 58 stores as part of its efficiency improvement programme. 1,800 stores openings target (excluding closures) for 2019 remains unchanged

Growth drivers

- Perekrestok launched its online business in 2017, its aim is to gain leadership in the online food retail space by 2020, it is set to compete with other companies in the online fast-food market and expects to achieve positive EBITDA by 2021. By late 2019, Perekrestok plans to achieve 8,000 orders per day, more than tripling yoy revenue

- In 2Q19 Perekrestok online orders quadrupled yoy topping 1,500 per day. In August 2018, X5 opened its first dark store in Moscow as part of the Perekrestok.ru online supermarket, in October a dark store was launched in St Petersburg. In 2018, the online supermarket handled 408,000 orders including 200,000 in 4Q18. The Group experiences seasonal effects on its business − increased customer activity in December results in an increase in sales made by the group (approximately 25–40% higher than annual monthly average)

- X5 left its guidance of 80–90 bln roubles for total Capex in 2019 unchanged despite H1 2019 capex totalling 34.2 bln roubles, which is below its budget for the first half of 2019. X5’s total capital expenditure amounted to 21.8 bln roubles in Q2 2019, compared to 20.4 bln roubles in Q2 2018. Approximately 54% of Capex in Q2 2019 went to expansion of X5 store base. X5 plans ramp up investments in digital transformation and roll out the new pricing system based on big data technologies to all of the stores (currently it is only in 1,700 stores). The new pricing system is delivering positive results, management suggests

Dividends

- In 1H19 X5 has built a solid base for the next dividend, which it plans to pay out in 2020, X5 CEO Igor Shekhterman said. In July, X5 paid dividends for 2018 in the amount of 25 bln roubles, or 92.06 roubles per GDR, which was 87% of X5 Retail Group’s 2018 net profit. According to X5 dividend policy, its target dividend payout ratio is at least 25% of IFRS consolidated net income. When deciding on dividends, the company is guided by the target net debt/EBITDA ratio under 2x. At the end of Q2 2019 X5 net debt to EBITDA ratio decreased to 1.59x from 1.7x in 2018. The management does not disclose dividends outlook for 2019

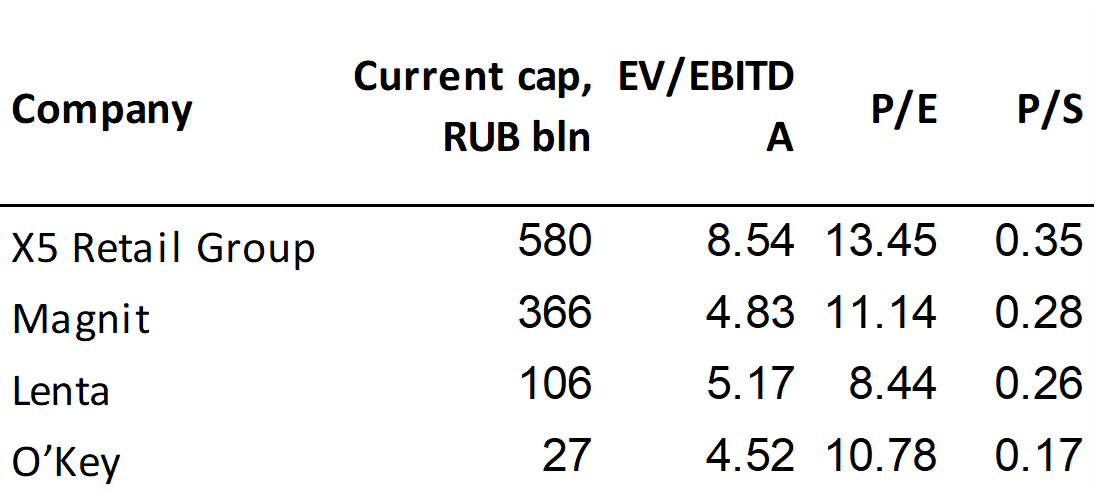

- Despite high multiple-based valuation against its peers, we believe X5 GDRs are attractive investment targets. Bloomberg 12M consensus is 37.09 per GDR (+16% from 16.08.2019). Upside potential through January 2020 is 13%, target price is $36.8, according to our estimates

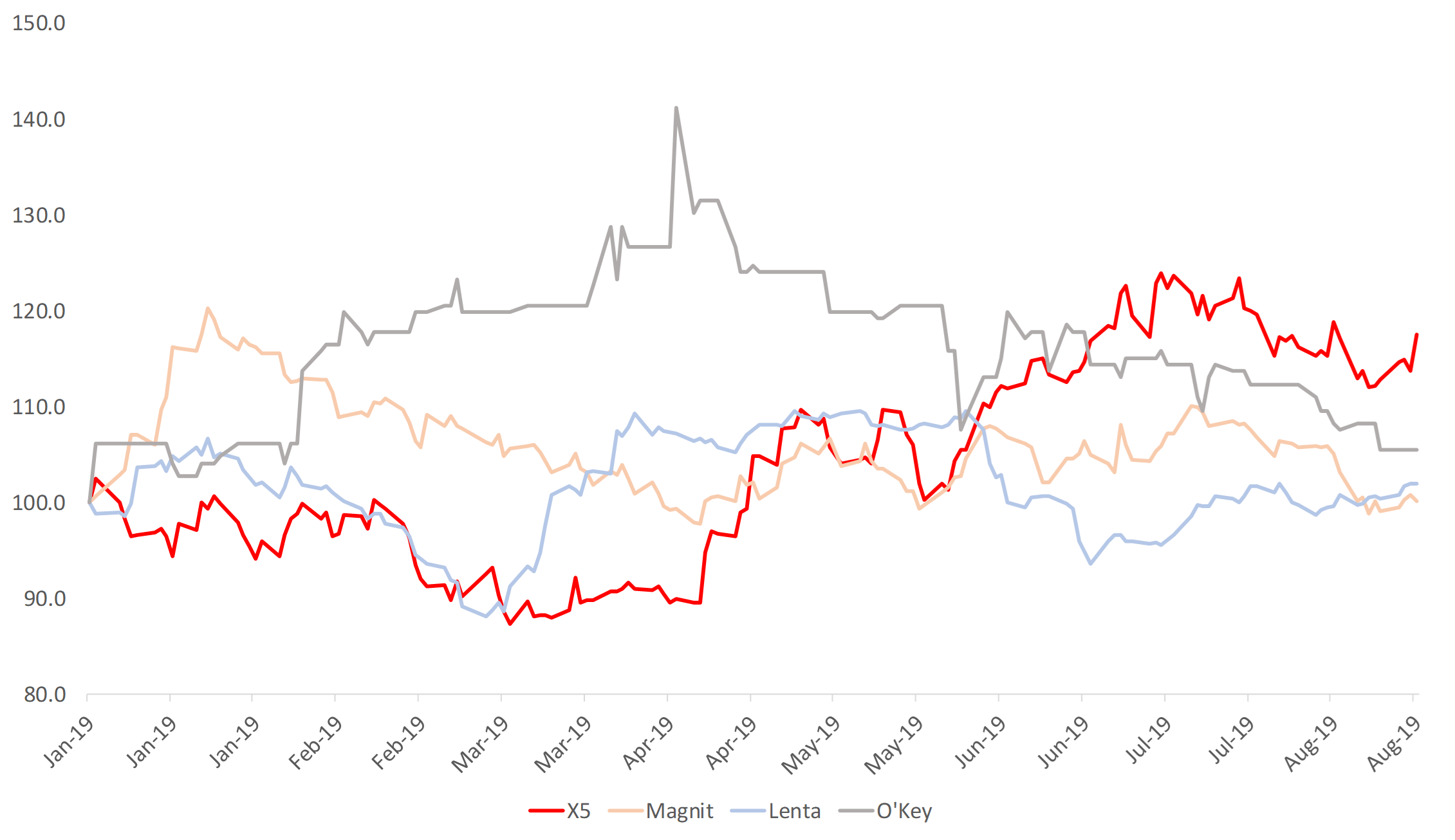

Normalized share prices of Russian retailers

Source: ITI Capital, Bloomberg