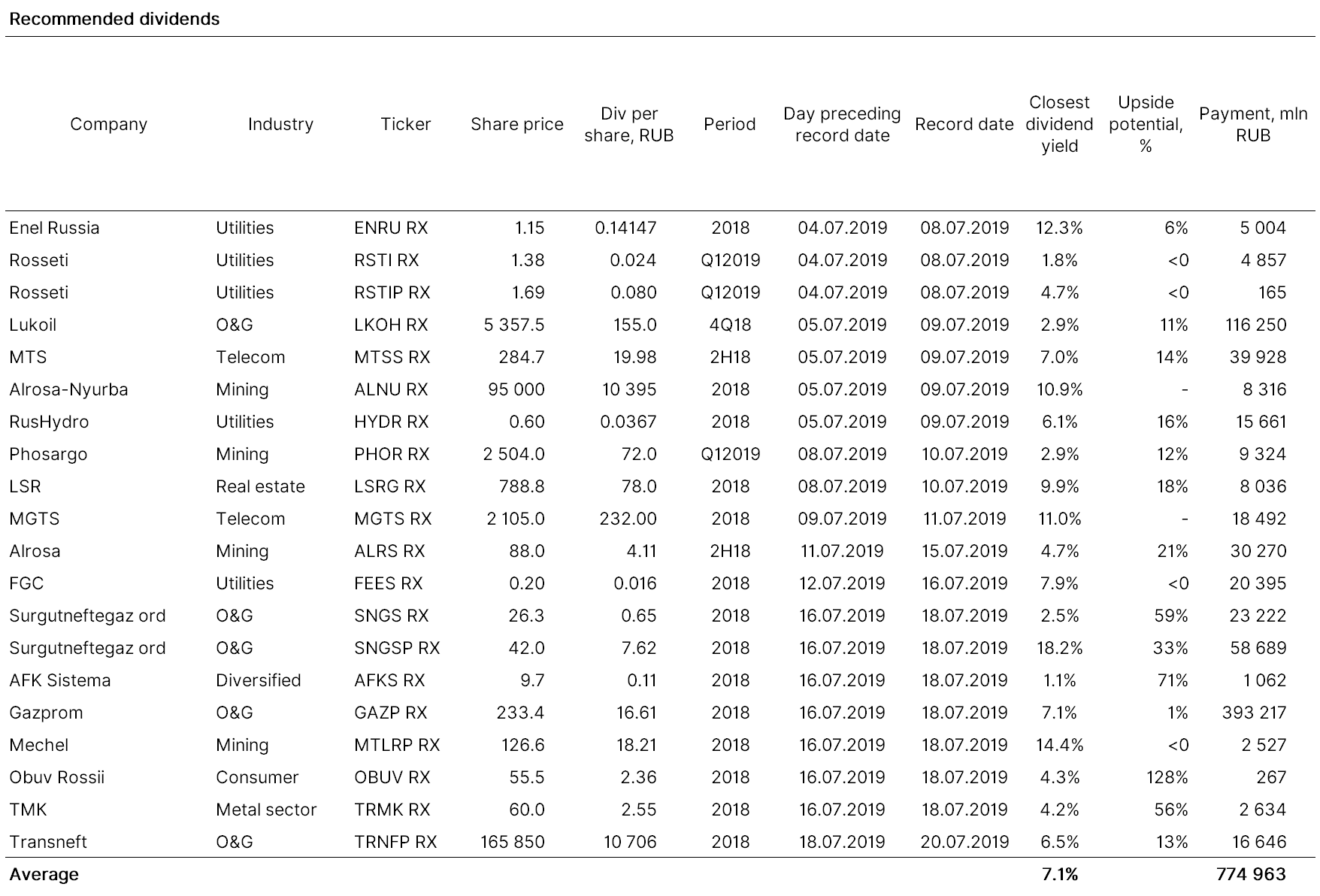

Since the start of the season in April, Russian corporates paid out over 800 bln roubles in dividends (today Rosneft pays 121 bln roubles in interim dividends). International custodians converted into FX about $4 bln for depositary receipt holders and international financial institutions.

The outstanding payments due this year amount to 1,127 trln roubles, out of which 686 bln roubles (61%) are due in July, the outstanding 440 bln roubles will be paid in the beginning of August (the bulk, 393 bln roubles, account for Gazprom).

About 60% of July payments account for the oil and gas sector and 20% for mining.

A total of $4.5 bln are expected to be converted into currency for dividend payments to foreign holders in July, the same amount — from the beginning of August until August 10. The tight timeline will certainly have an adverse impact on the rouble, which is seen to trade slightly above 64 towards 64.5 roubles, according to our estimates.

Top picks ahead of dividend payments

The main local driver in the Russian market is dividend payments due to active buying and reinvestments after payments.

In the run-up to July’s record date, it is reasonable to take a look MGTS (11%) and FGC (8%) that are among the top yielders. Next week’s top pick is clearly Surgutneftegaz pref (18 +%), the company’s yields will drop materially next year, given that the USDRUB is unlikely to exceed 65 by the end of the year and the rouble will be 6% stronger than at the last year’s end.