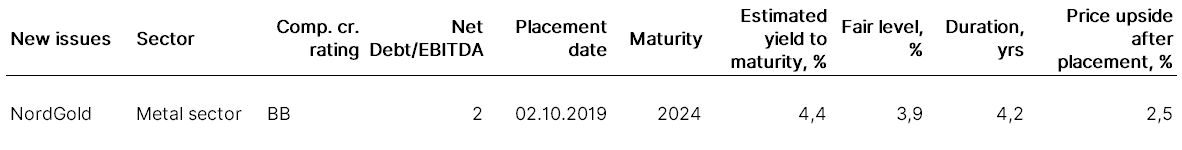

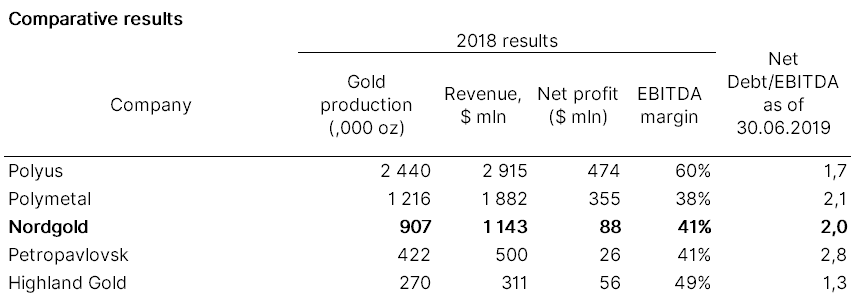

- Nordgold, Russia's third largest gold producer (Ba2/BB) following Polymetal and Polyus (see table below), has placed $400 mln of eurobonds with 4.125% coupon

- Maturity date — October 9, 2024. The book closed on October 2

- We believe that Nordgold's debut issue should trade at a 40-bps premium to Evraz and at much higher premium to Polyus. Therefore, the yields downside is limited to 40–50 bps from the current level

- Nordgold's current cost of liabilities in FX is about 4%, or Libor +2%, hence current yield is justifiable

- Polyus’ net profit is five times that of Nordgold, the company has a lower net debt/EBITDA ratio, but we believe that the Polyus bond looks overvalued.

Russia's corporate curve

Source: ITI Capital, Bloomberg

Company profile

- A gold mining company founded in 2007 with assets in Russia, Kazakhstan and Africa

- 99.94% of the equity capital is owned by Alexey Mordashev and his family

- Production increased from 21,000 ounces in 2007 to 907,000 ounces in 2018 due to organic growth and assets acquisition

Assets

- Nordgold has mines and development projects, as well as investment projects in six countries — Burkina Faso, Guinea, Russia, Kazakhstan, French Guiana and Canada

- Proven and probable gold reserves amount to 15.1 mln ounces, total resources amount to 26.4 mln ounces

- Gross, Nordgold’s new flagship mine in the southwestern Yakutia, launched in September 2018, it is the largest project developed by the company from exploration to production over the last six years. Total proven and probable reserves amount to 5.3 mln ounces gold equivalent, roughly one third of the company’s total reserves and is one of the largest gold mines in Russia and in the world. The Gross mine is an open pit heap leach operation with the lowest production costs across Nordgold’s mine (total cash cost is $338/oz, against $732/oz in average)

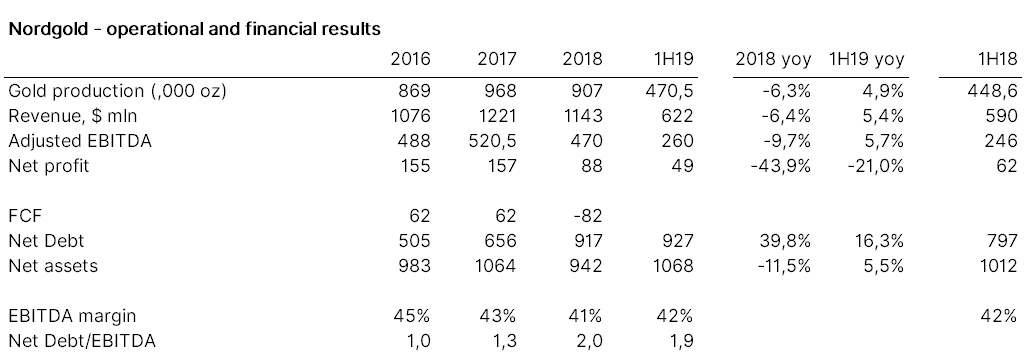

Operating and financial performance — stable

- Refined gold production decreased in 2018 due to an increase in lower grade material processing, as the Berezitovy production dropped due to a rockslide. 1H19 refined gold production increased mainly driven by the ramp up at the Gross mine (accounts to 22% of total production), that partially offset temporarily reduced recoveries at other mines

- Revenue stood at $1.1–1.2 bln over the past three years, EBITDA margin was above 40%

- 2018 and 1H19 net profit decrease was driven by the partial assets value write-off due to reassessment of prospects of certain mines. 1H19 and 2018 impairment loss under IFRS was $45 mln and $39 mln respectively

- In 2018, the Group had negative free cash flow of $ 81.7 mln mainly due to peak investment commitments related to the construction of the Gross mine

- The company has moderate leverage with a target level of below 2x

Outlook

- Gold production at the Gross mine in 2019 is expected to reach 200,000 oz (1H2019: 103,000 oz), the group’s total production — over 1 mln oz. Management expects EBITDA to grow to around $600 mln (+28% yoy) and a positive FCF of over $100 mln in 2019

- Over the next five years, the company's investments will amount to $400–450 mln per year, positive free cash flow is expected at all mines due to improved operational performance, cost efficiency and capital investments monitoring

- The company's key projects expected to be commissioned within the next four to five years: The Montagne d’Or development project in French Guiana hosts proven and probable reserves of 1.5 million ounces of gold) and the Tokkinsky deposit close to the Gross mine

Risks

- Production at the mine is subject to significant seasonal variations and depends on weather conditions. The majority of crushing and stockpiling of ore occurs from May to September each year, while in West Africa the wet seasons from June to October may lead to suspension of production in case of floods

- The company faces operational and exploration risks typical for the industry: the risk of faster production decrease across current assets, unsuccessful exploration of new projects or higher commissioning costs

- The company does not hedge its gold price risk. The company is benefiting from the current prices standing at $1500/oz, but if prices decrease operating margin may decline

- The risk of new impairment losses is quite low, as the company believes that the current estimate to be more conservative and the rise in gold prices improves the mines’ expected economy